By Andrew C. Snyder, Philosopher at UmbrellaCAST, April 28, 2019

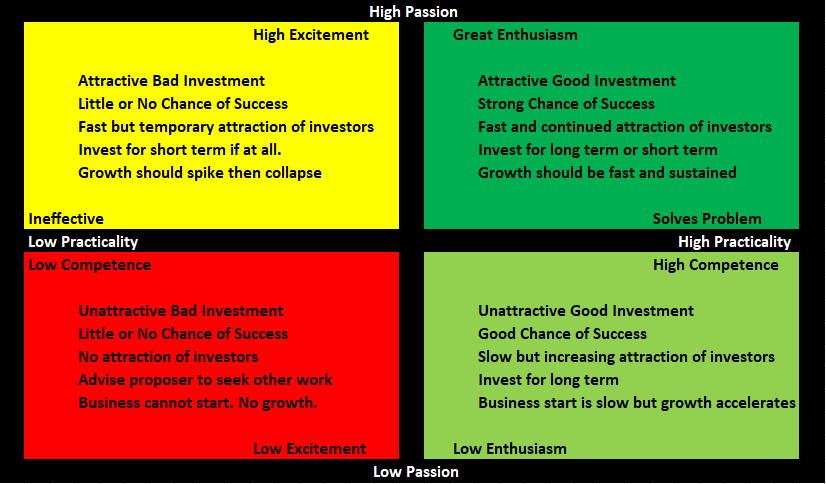

Orthogonal representation of the interaction between high passion and high practicality can be used as an assessment for relative investment strength among start-ups. The combination of great enthusiasm and high practicality gathers investors and creates lasting growth, while the combination of low passion and low practicality will likely never attract investors and will fail in the earliest stages.

Hybrid combinations of high/low create specialized investment opportunities. High Excitement for an Ineffective project will attract investors who evaluate the opportunity superficially. Such an investment becomes a hot-potato that has to be dropped before its futility is widely realized. In contrast, the highly practical opportunity with low enthusiasm and understated marketing presents a unique Blue Ocean type of investment where the investor who takes the time to understand and invests early is rewarded with sustainable growth over the long run and the opportunity for dramatic, sudden increase in the event that opportunity becomes more widely known. Such an investment is visible only to the investor with unborrowed vision who can recognize value and opportunity based on merit in the absence of hype.

Since hype will tend to overvalue those opportunities that begin with high passion, such investments will grow only inasmuch as the practical value of the business increases or as hype continues to grow. When the hype diminishes, even the high practicality investment will lose value. In contrast, since hype has a neutral or unfavorable impact on the perceived value of an unenthusiastically presented opportunity with genuine practical value, opportunities for growth are rooted in both practical growth and increase in hype.